PowerGrid InvIT set to announce IPO, Check out the dates

IPO will have a fresh issuance of around Rs 4,994 crore, PowerGrid Infrastructure Investment Trust mentioned

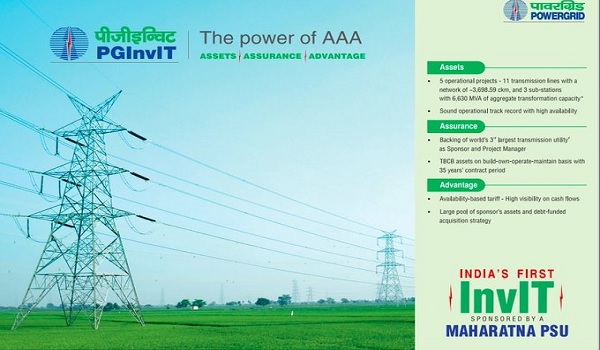

New Delhi: Power Grid Corporation of India Limited, a Maharatna Public Sector Undertaking to announce the IPO of its first Infrastructure investment trust (InvIT). The IPO will be open on April 29 and set to close on May 3, 2021.

The PowerGrid Infrastructure Investment Trust mentioned that IPO will have a fresh issuance of around Rs 4,994 crore. It was further mentioned that the listing will be at BSE Sensex and NSE Nifty.

PowerGrid will monetise the five initial portfolio assets with a value of Rs 10, 384 crores for InvIT. The price band of Powergrid InvIT's IPO will be Rs 99-100/Sh.

PowerGrid states in a press note, POWERGRID InvIT is issuing Units aggregating up to Rs 49,934.84 million (“Fresh Issue”), and the Selling Unitholder is offering Units aggregating up to Rs 27,415.08 million. The Anchor Investor Bidding Date shall be one Working Day prior to the Bid/Offer Opening Date i.e. April 28, 2021. The Units of POWERGRID InvIT are proposed to be listed on BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”, together with BSE, the “Stock Exchanges”). The Trust has received in-principle approvals from BSE and NSE for a listing of the Units pursuant to letters dated February 2, 2021, and February 3, 2021, respectively. This Offer will constitute at least 10% of the outstanding Units on a post-Offer basis.

The Net Proceeds from the Offer will be utilised towards the following objects: (i) providing loans to the Initial Portfolio Assets for repayment or pre-payment of debt, including any accrued interest, availed by the Initial Portfolio Assets; and (ii) for general purposes. This Offer is being made through the Book Building Process and in compliance with the [InvIT Regulations and the SEBI Guidelines,] wherein not more than 75% of the Offer shall be available for allocation on a proportionate basis to Institutional Investors, provided that the Investment Manager and the Selling Unitholder may, in consultation with the Lead Managers, allocate up to 60% of the Institutional Investor provides to Anchor Investors on a discretionary basis in accordance with the InvIT Regulations and the SEBI Guidelines.

Further, not less than 25% of the Offer shall be available for allocation on a proportionate basis to Non-Institutional Investors, in accordance with the InvIT Regulations and the SEBI Guidelines, subject to valid Bids being received at or above the Offer Price.

Bids can be made for a minimum lot of 1,100 Units and in multiples of 1,100 Units, therea]er by Bidders other than the units subscribed for by Anchor Investors. IDBI Trusteeship Services Limited is the Trustee, while Power Grid Corporation of India Limited is the Sponsor. POWERGRID Unchahar Transmission Limited is the Investment Manager.

The Lead Managers to the Offer are ICICI Securities Limited, Axis Capital Limited, Edelweiss Financial Services Limited, and HSBC Securities and Capital Markets (India) Private Limited.

Read Also : Coal India Organises Training programme for capacity buildingNews Must Read

- SJVN CMD Geeta Kapur Inaugurates Construction Works at Sunni Dam Project in Himachal Pradesh

- PESB Selects R Veerabahu as Director (Finance) for Braithwaite & Co. Limited

- Grew Energy bags largest order of 200 MW Contract of SECI's Auction

- CPCL Reports 39% YoY Drop in Q4 Net Profit, Declares Rs 55 per Share Dividend

- SJVN Limited inaugurates India's first Multi-purpose Green Hydrogen Pilot Project

- KRDCL, RVNL JV emerges as the Lowest Bidder for Redevelopment of Thiruvananthapuram Central Railway Station

- REC Ltd. has incorporated subsidiary company BPTL

- Hon’ble Vice President of India Confers `Outstanding PSU of the Year’ Award on HAL

- BharatPe Launches India’s first All-in-One Payment Device

- NBCC registers historical Performance in FY2023-24