How to Build a Diversified Stock Portfolio?

Representational Image

Imagine a basket of chocolate with candies, bars, wafers, dark chocolate, and milk chocolates. Does it not make a perfect gift? The variety makes it more appealing, attractive and worth gifting. Similarly, a diversified stock portfolio spreads your funds across varied stocks to reduce market risk and enhance your chances of higher returns. It makes the portfolio resilient, healthier, and more attractive.

The volatility of the market and the risks it brings to an investor's life can cause real stress. Diversification is the safety belt that can reduce the impact of market instability. If one stock plummets, others may perform well, stabilising your portfolio.

Here, we will simplify diversification for you and walk you through the elements of a well-balanced portfolio and how to build one for yourself, whether you are a rookie or a seasoned investor.

Understanding Diversification

Diversification can be defined as a strategy for risk management where you create a mix of various assets in one portfolio. A diversified one consists of distinct asset types like debt, equity, fixed assets, and other investment instruments with an attempt to reduce the risk of exposure to any single asset class.

A few benefits of diversification include:

-

Risk reduction by spreading your risks so that your portfolio performance is not shouldered by a single asset or stock.

-

Smoother returns are achieved by creating a balance with the performance variability of stocks in a volatile and impactful market.

-

Exposure to multiple sectors like healthcare, energy, technology or infrastructure keeps you ready for any future mishaps in specific sectors. The performing sectors keep you ahead of the game, even if others try to pull your returns down.

However, even diversification has its limits. Over-diversifying your portfolio dilutes your returns and makes it difficult to manage efficiently. Under-diversification with too few stocks makes your portfolio highly vulnerable to even the smallest market corrections.

Key Elements of a Diversified Stock Portfolio

The important categories through which you can successfully diversify your investments are many. However, you should only take a call after evaluating their performance under various market conditions.

Spreading your corpus across technology, infrastructure, healthcare, finance, and manufacturing helps to counter market downfalls as sectors react differently to market volatility. Further amongst the industries, you can balance your funds within large caps like Apple and Microsoft, mid-cap innovators, and aggressive small-cap start-ups. All these together have the potential to give your investments stability and a potential for higher returns.

Look beyond the domestic markets to take advantage of the economic boom in your neighbouring countries. A good and strategic mixture of growth stocks and value stocks can give you a high upside, though with a risk, and also provide solid returns with low volatility. Dividend yield stocks are ideal for conservative, aged investors as they provide regular income. On the other hand, if your objective is wealth creation, non-dividend stocks work best as they reinvest profits and aid in long-term growth.

Step-by-Step Guide to Building a Diversified Portfolio

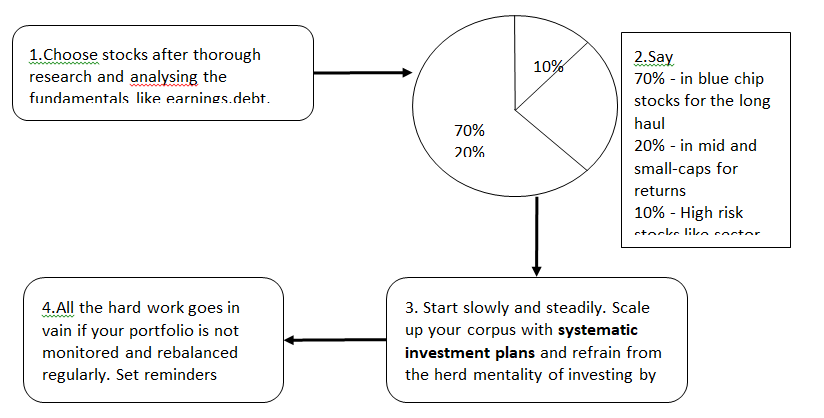

This brief chart will walk you through the steps to build a diversified portfolio :

-

Choose stocks after thorough research and analysing the fundamentals like earnings, debt, leadership and market position.

-

Say 70% - in blue chip stocks for the long haul, 20% - in mid and small-caps for returns and 10% - High risk stocks like sector-specific ETFs, etc., based on your asset allocation and risk appetite.

-

Start slowly and steadily. Scale up your corpus with systematic investment plans and refrain from the herd mentality of investing by following others. This further helps in risk mitigation.

-

All the hard work goes in vain if your portfolio is not monitored and rebalanced regularly. Set reminders monthly, annually or quarterly to track and review your investments.

Know Your Investment Goals and Risk Appetite

Before getting your hands dirty, think hard about your investment goals and how they will support your life goals. If you are looking forward to owning a car, your investment approach will have short-term goal requirements. But if you are accumulating wealth for your retirement, children's education or marriage, your investments should have long-term goal orientation. However, above all, the risk tolerance factor should be of main importance. You do not want to strain your current financial condition, which may hamper your and your family’s lifestyle and basic requirements. Invest amounts that you will be able to continue with our future income and tolerate a minimum loss. Time is also of the essence. If you feel you will need some funds in a few years and might not be able to take high-risk, go for dividend yield stocks. If you feel your invested amount can be kept for 10-15 years, do give high-risk stocks a try as a part of your portfolio for a substantial gain.

Conclusion

Considering the risk factor and market movements, and sensitivity to external factors, diversification is not just a smart strategy but an essential one. It's an armour to market shocks which are beyond your control, offering a new opening to diverse sectors which you might not even be aware of and assists in making a smoother financial decision. Revisit your strategy as the market evolves, diversify your stocks as new opportunities arise, keep yourself updated with apt knowledge and do not quit. You will be a happy investor no matter what.

Join PSU Connect on WhatsApp now for quick updates! Whatsapp Channel

Read Also : Odisha Mining Corporation's Dubna Mines Commences Despatch Operations