RBI MPC: Policy repo rate unchanged at 4%, reverse repo 3.5 %

The Governor of Reserve Bank of India (RBI) Shaktikanta Das said the MPC voted to maintain the repo rate at 4 percent and reverse repo rate at 3.35 percent. The accommodative policy stance will continue.

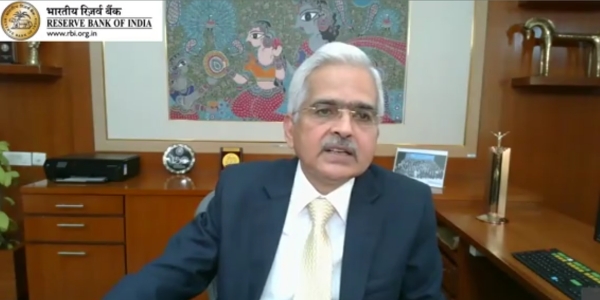

RBI Governor Shri Shaktikanta Das while interacting with media on RBI's Monetary policy

New Delhi: The Governor of Reserve Bank of India (RBI) Shaktikanta Das said the MPC voted to maintain the repo rate at 4 percent and reverse repo rate at 3.35 percent. The accommodative policy stance will continue.

The MPC also decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

The MPC maintained its Gross Domestic Product (GDP) growth forecast at 10.5 percent for FY22. The Monetary Policy Committee's policy announcement comes amid elevated inflation and surge in COVID-19 infections across the country.

The Monetary Policy Committee (MPC) met on 5th, 6th and 7th April, 2021 and deliberated on current and evolving macroeconomic and financial developments, both domestic and global. The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent. It also unanimously decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. The marginal standing facility (MSF) rate and the bank rate remain unchanged at 4.25 per cent. The reverse repo rate stands unchanged at 3.35 per cent.

Shaktikanta Das said, "rural demand remains buoyant and record agriculture production in 2020-21 bodes well for its resilience. Urban demand has gained traction and should get a fillip with the ongoing vaccination drive. The recent surge in COVID-19 infections, however, adds uncertainty to the domestic growth outlook amidst tightening of restrictions by some state governments."

Join PSU Connect on WhatsApp now for quick updates! Whatsapp Channel

Read Also : BEML, DPA, DMRC, and Umeandus Collaborate to Pioneer India’s Smartest Rail-Based Freight System