bank-news

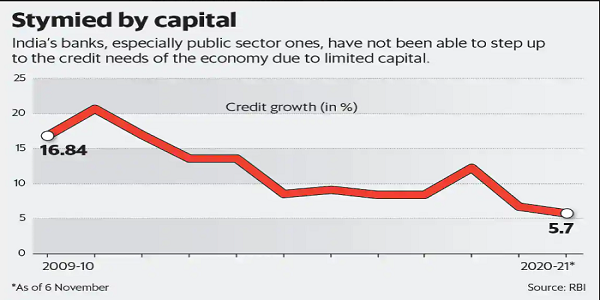

Indian banks including public sector not been able to set up the credit needs due to limited capital

The new gateways of the banking towards a big conglomerate and turning the major non-financial companies (NBFCs) into the mainstream banks.

Data Source (RBI), Image Source (Livemint)

New Delhi: The continuous decline in the credit growth since 2009-10 till 2020-21 it is showed that the Indian Bank including the public sector banks has a drawback and unable to set up the credit needs of the economy due to limited capital.

The new gateways of the banking towards a big conglomerate and turning the major non-financial companies (NBFCs) into the mainstream banks, that is what RBI suggests in its latest conference meet. Meanwhile, stabling into the roots RBI has not allowed foreign banks to buy private sector banks.

At the same time due to the limited capital flow in the private and as well as in the public sector banks are not been able to set up the credit needs of the economy. The whole process of spiking the economy is big banks with easy finance and flow of capital.

All eyes in the NBFCs and big conglomerates with the large scale lending, engaging in the business of loans, securities, insurance and many more can serve the best capital in banking.

Join PSU Connect on WhatsApp now for quick updates! Click here

Read Also : RailTel bags work order from CWC worth Rs 96.99 crore

Read Also : RailTel bags work order from CWC worth Rs 96.99 crore