RBI to unveil e-rupee transactions soon

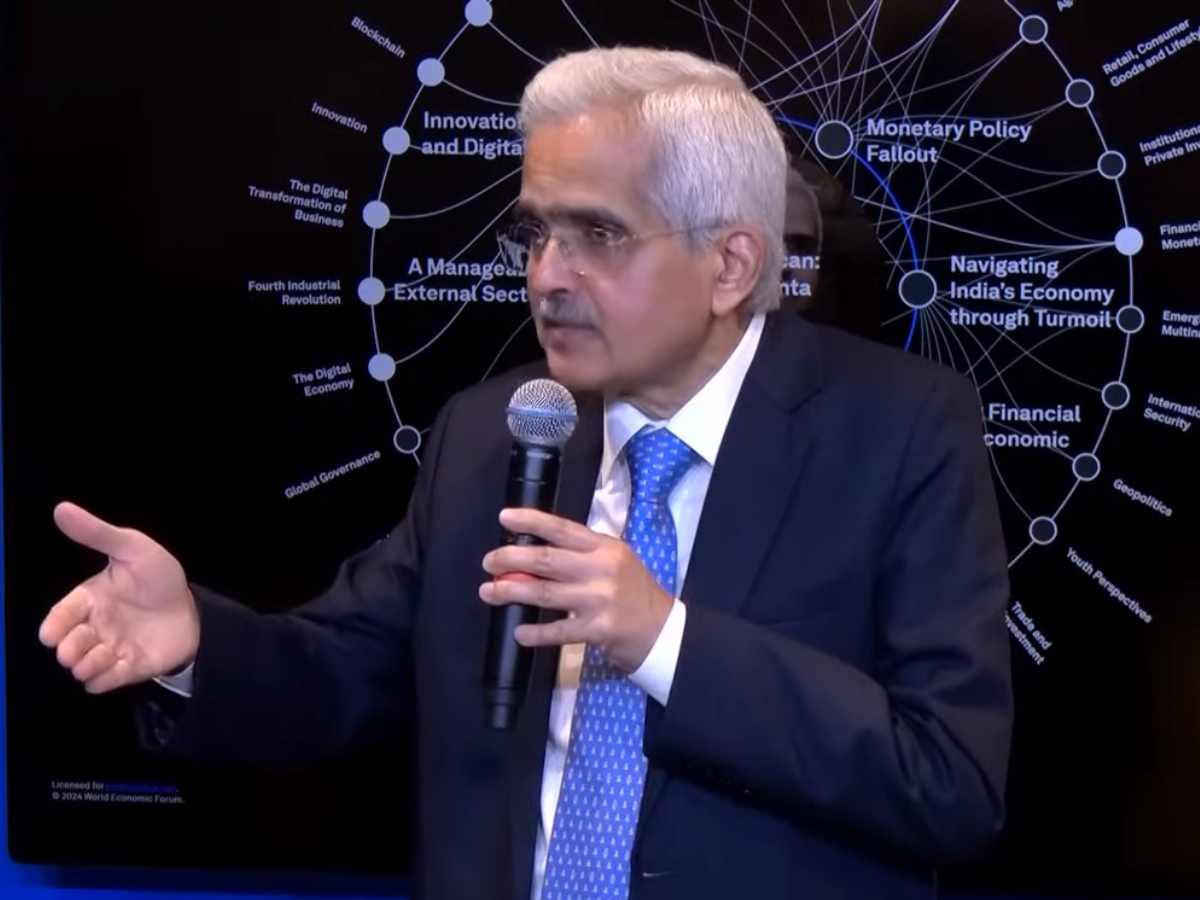

As per the last monetary policy committee meeting reports, RBI governor Shaktikanta Das has assured to soon unveil e-rupee offline transactions which could enable digital rupee users to execute transactions in areas with limited internet connectivity.

As official statements announced, the programmability-based additional use cases will be introduced as part of the pilot project. RBI had launched a pilot of the retail CBDC in December 2022 which later achieved the target of having 10 lakh transactions per day in December 2023.

The Central Bank has proposed introducing an offline functionality in CBDC-R [Retail] to enable transactions in areas with poor or limited internet connectivity. Multiple offline solutions, which include both proximity and non-proximity-based ones will be tested across hilly areas, rural, and urban locations for the purpose.

On the programmability front, the system enables Person-to-person [P2P] and Person to Merchant [P2M] transactions using digital rupee wallets provided by pilot banks.

Join PSU Connect on WhatsApp now for quick updates! Whatsapp Channel

Read Also : BEML CMD, Shantanu Roy shares bold and future-ready vision at NUTI Summit 2025The programmability feature will permit users like government agencies to ensure that payments are made for defined benefits whereas corporates will also be able to program specified expenditures like business travel for their employees. Meanwhile, the Bank authority is working on the intent to enhance the security features of Aadhar-enabled Payment Systems [AePS] which were used by 37 crore people in 2023.

Read Also : NTPC Talcher Kaniha planted 6,000 trees in tree plantation programTo enhance the security of AePS transactions, it is proposed to streamline the onboarding process which includes mandatory due diligence, for AePS touch point operators, to be followed by banks.

To facilitate the further use of such mechanisms for digital security, it is proposed to adopt a principle-based 'Framework for authentication of digital payment transactions'.

Read Also : MIDHANI CMD and Director (Production & Marketing) gets Extension