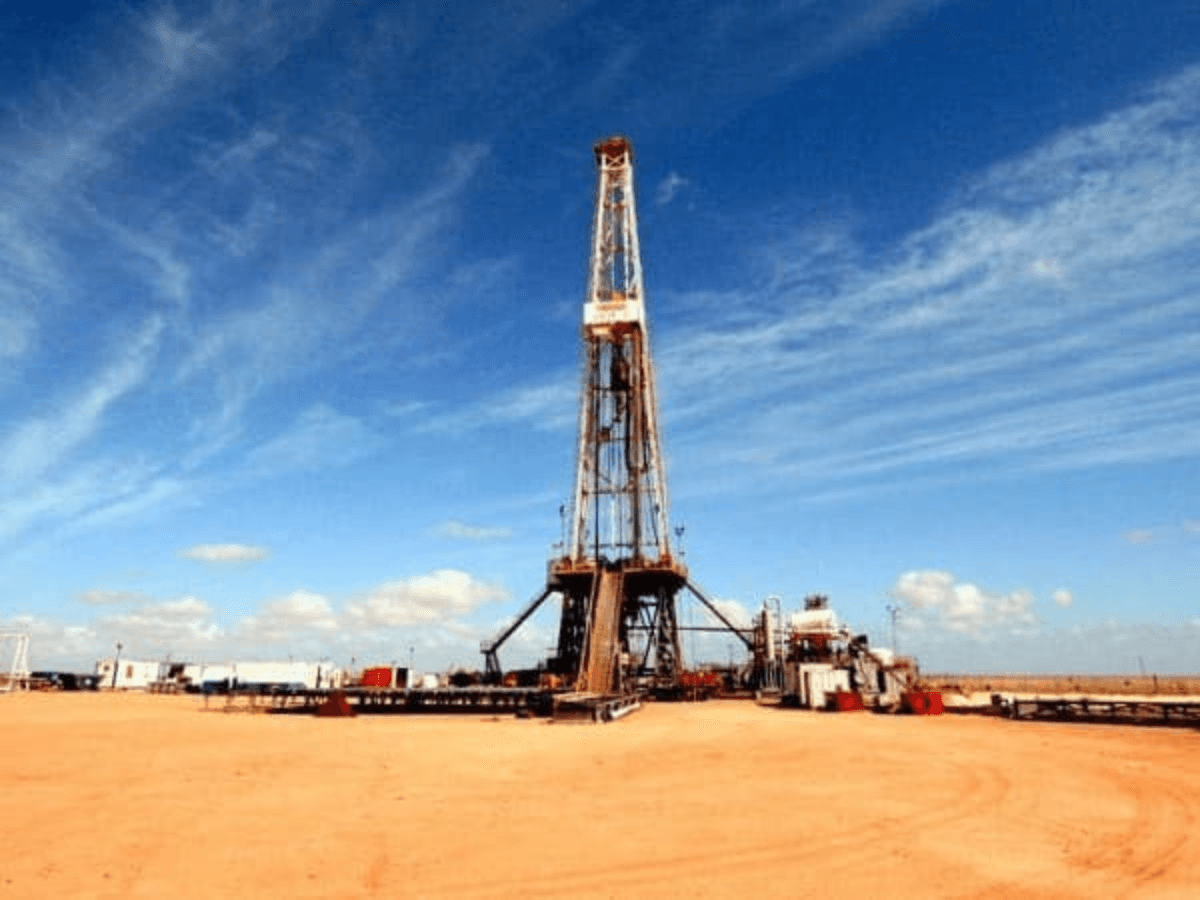

Oil and Gas Companies reported unusual revenue, shares muted with no gains

New Delhi: The recent provisional trends from the ongoing financial output revenue earnings suggest Oil companies have posted single-digit growth in both revenue and profit for the quarter that ended September 30, with a muted performance by oil and gas companies offsetting a stellar show in the financial services sector.

The shares are also reportedly muted and revenue roses by 7.2% from a year earlier, the slowest in five quarters, according to an analysis of the numbers from 175 companies that have reported results for the fiscal second quarter. Some other PSU companies are yet to disclose their financial results.

Net profit growth at 2.5% was a six-quarter low, even as the operating margin of the sample group fell 1.5 percentage points to 20.9%.

In the oil and gas sector, Reliance Industries, the country's largest company by revenue and market cap, and Mangalore Refinery and Petrochemicals Ltd (MRPL) have declared quarterly numbers so far. Reliance's consolidated revenue remained flat from a year earlier at Rs 2,35,481 crore, while net profit fell nearly 3% to Rs 19,323 crore.

For MRPL, revenue grew 26% to Rs 28,785.9 crore, but MRPL, a subsidiary of the Oil and Natural Gas Corporation (ONGC), reported a net loss of Rs 696.9 crore compared with a profit of Rs 1,051.7 crore a year earlier due to a sharp drop in gross refining margin. These two companies together accounted for one-third of the sample's revenue and 17% of its net profit.

Financial services companies including banks posted a 14% expansion in revenue and a 13% increase in net profit. Excluding them, the revenue of the sample group grew 5.3%, but net profit fell 3.6% year-on-year. Lenders together contributed 23.2% to the sample's revenue and 40.3% of net profit.

Analysts had predicted modest growth for corporate India in the second quarter, citing pressure on demand. According to a preview report by Elara Securities (India), "Q2FY25 is expected to be the first quarter in seven to experience a decline in both year-over-year and quarter-over-quarter earnings, as domestic cyclical may find it challenging to fully counteract the ongoing difficulties in commodity sectors."