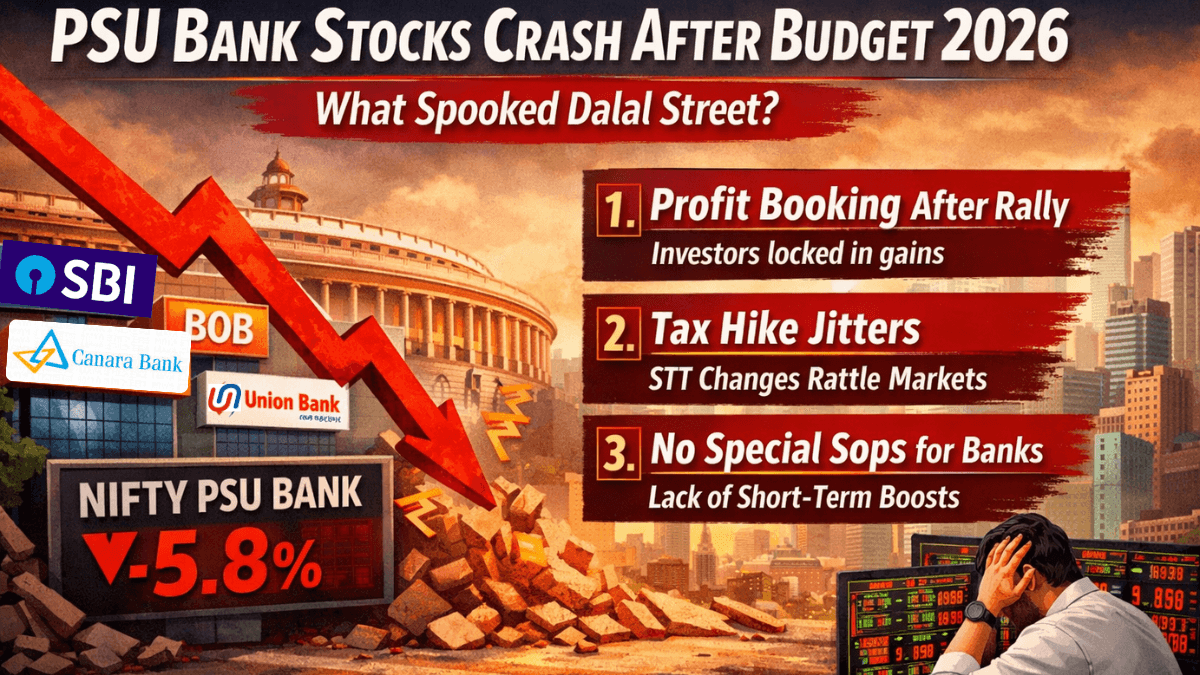

New Delhi: Public sector bank stocks came under sharp selling pressure on Saturday after the presentation of the Union Budget 2026, with investors choosing to book profits amid tax-related concerns and the absence of immediate sector-specific relief.

Shares of major PSU lenders including State Bank of India, Bank of Baroda, Canara Bank, Union Bank of India and Indian Bank declined sharply in early trade, dragging the Nifty PSU Bank index lower. The sell-off came despite the government reiterating confidence in the strength of the banking system.

What Triggered the Fall in PSU Bank Stocks?

Market participants pointed to a combination of factors that led to the decline in PSU banking stocks post Budget:

1. Profit Booking After Strong Rally

PSU bank stocks had rallied significantly over the past year on the back of improved asset quality, lower NPAs and strong credit growth. With valuations stretched, many investors used the Budget event as an opportunity to lock in gains.

2. Higher Market Volatility After Tax Changes

Changes related to Securities Transaction Tax (STT) on derivatives impacted overall market sentiment. Banking stocks, which are among the most actively traded, bore the brunt of the negative reaction.

3. No Immediate Big-Bang Announcements for Banks

While the Budget focused on long-term reforms, there were no direct short-term incentives such as recapitalisation announcements or tax benefits for PSU banks, leading to disappointment among traders.

Budget Signals Long-Term Reform, Not Short-Term Cheer

Despite the market reaction, Finance Minister Nirmala Sitharaman emphasised that Indian banks remain financially strong, with improved balance sheets and capital adequacy.

The Budget proposed the formation of a high-level committee on “Banking for Viksit Bharat”, aimed at reviewing governance standards, operational efficiency, credit delivery mechanisms and technological adoption across banks and NBFCs.

Experts believe these measures are structural in nature and may take time to reflect in stock prices.

PSU Stocks Beyond Banks Also See Volatility

Apart from banks, several other PSU stocks witnessed volatility as the government announced an ambitious ₹80,000 crore disinvestment and asset monetisation target for FY27. While infrastructure-linked PSUs gained on higher capital expenditure, concerns over stake dilution kept investor sentiment cautious.

What Should Investors Watch Next?

Market analysts say the near-term reaction is sentiment-driven rather than fundamental:

-

Infrastructure push may support long-term credit growth

-

Banking governance reforms could improve efficiency over time

-

PSU banks’ earnings trajectory remains intact despite market volatility

Bottom Line

The fall in PSU bank stocks after Budget 2026 reflects short-term caution and profit booking, not a deterioration in fundamentals. While markets reacted nervously to tax changes and reform timelines, analysts believe the long-term outlook for PSU banks remains stable, supported by economic growth and improved balance sheets.